2500 Puffs Disposable ecig have a completely enclosed design, reducing the need for charging and replacing cartridges. The no-charge design also reduces the occurrence of faults. It is understood that with rechargeable e-cigarettes, each cartridge needs to be charged at least once and the battery efficiency is extremely low, while the design of disposable ecig can solve this problem very well. 2500 Puff Disposable Vape,Disposable Mini Vape Stick,Puff Disposable Vape,Mini Puff Disposable Vape Shenzhen E-wisdom Network Technology Co., Ltd. , https://www.globale-wisdom.com

On August 5th, Netflix, a streaming video service provider in the United States, announced that the company will formally launch services in the Japanese market on September 2 and formally enter the Asian market.

Netflix currently offers streaming video services in dozens of countries outside the United States. Netflix said earlier that the company will enter the market including Portugal, Japan, Italy and Spain by the end of next year. At the same time, Netflix also hopes to enter the mainland China market through alliances with other companies.

Regardless of when and how Netflix will enter China, its involvement in the Japanese region has whistled its way into the Asian market. Netflix has great ambitions in the global business layout. The media analyzes the operational thinking of this global content service provider for you.

Simple Law Thinking: Business Development

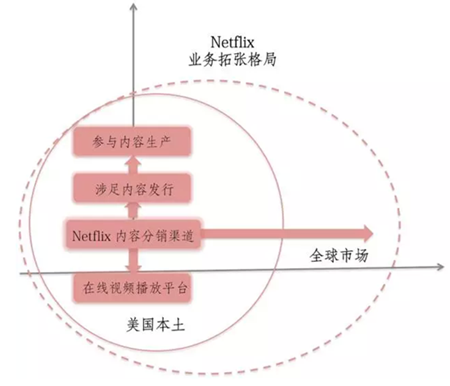

Compared with the big media empire, Netflix, established in 1997, is an absolute lightweight player and its business layout follows a simple rule. On the surface, the Netflix landscape after the transformation in 2007 is still simple, consisting of the core online video services and the retained DVD rental business. However, surging tides, Netflix's "Simple Thinking" has shown a convergence trend, its business: from the breadth of the United States to accelerate the expansion of the global market overseas; in depth from purely content playback to the upstream of the industrial chain to extend the content production With the issuance and diversification of cooperation with network operators and terminal manufacturers to the downstream of the industry chain, while trying to control the content to enhance the strength, one side is closer to the user to expand the scale. In this way, an Internet company that is moving from DVD leasing to online video services can easily achieve comprehensive convergence through a streamlined business landscape.

Breadth: Based on the United States

If the trial users are also counted, as of the end of the second quarter of this year, Netflix has nearly 65.5 million subscribers worldwide, more than double the number of subscribers three years ago. In the second quarter of this year alone, Netflix added 900,000 and 2.37 million new subscribers to the U.S. market and international market, respectively. Netflix expects the number of new users in the US and global markets to reach 1.15 million and 2.4 million in the third quarter of this year. At present, the total number of Netflix U.S. subscribers is approximately 42.3 million. Obviously, the user's growth momentum shows strong momentum.

Users are increasingly accustomed to holding content control rights, and Netflix seizes the worldwide trend of increasing demand for Internet video on demand to the international market. Once overseas markets form a scale of magnitude, global users will not only promote Netflix to continue to purchase or create exclusive releases of movies and TV dramas, but also attract more independent film producers to cooperate with them to get rid of the content of the six media groups. Control, share global audience and broadcast revenue.

In 2014, Netflix focused its efforts on the European market, landing in six European countries including Germany and France. Among them, Germany is the country with the largest number of broadband households in European countries and the market prospects are considerable. However, Netflix is ​​bound to face triple problems in expanding its global business. The first is the restrictive issues of each country, such as Brazil, which is relatively complex in terms of payment. The local market has not yet monopolized TVGlobal; the rules for film distribution in France are relatively complicated, and a film is only Three months after the movie theaters are publicly released, they can appear in monthly subscription video services. Second, Netflix will also face competition with other video service providers in overseas markets, such as CanalPlay Infinity, which is provided by France-based CanalPlus in France. Third, Netiflix is ​​investing heavily in content and promotion services to increase costs, in order to better anchor and open new markets. Netflix does not hesitate to sacrifice short-term interests and tries to resolve the three major issues one by one, broadening the breadth of its business and sticking to the global market.

Depth: Involved in production and distribution, business development in depth

The essence of Netflix has grown from a content distributor to a broadcast platform. The expansion of the business scale makes it eager to grasp the initiative and further expand market share. Extending the industry chain is imperative and Netflix is ​​more decisive. First, Netflix partnered with a number of North American independent studios to develop first-episode drama projects. In 2013, Netflix's self-made drama "House of Cards" expanded its content production with big data; it broadcasts one time and does not broadcast advertisements in an interim format, caters to user viewing habits, and innovates the traditional TV series broadcasting and broadcasting modes. Netflix also moves from the very end of the entire content realization chain to the upstream, expanding the original limited profit space.

The "Netflix first" distribution model also entered the film market. In October 2014, Netflix won the title of "Crouching Tiger, Hidden Dragon: The Qing Ming Sword" and four new movies and theaters of the famous American comedian Adam Sandler. Sandler's film will also be co-produced by Netflix and will be the exclusive premiere on Netflix's platform in more than 50 countries around the world. For users, the "Netflix first" movie release model means that Netflix users do not have to wait 7-18 months to see a brand new movie; for cinema and film publishers, this model is for traditional movie releases. The system has an impact and the proceeds of the issuance window system are being seized; for Netflix, this will undoubtedly expand its global user base and expand its market share to accumulate energy.

Mature but can not avoid a single profit model

On July 16, 2015, Netflix reported that its second fiscal quarter financial report for fiscal year 2015 showed that Netflix’s second-quarter revenue was US$1.64 billion, which was higher than the 1.34 billion US dollars of the same period of last year; net profit was US$26.3 million. The 71 million U.S. dollars in the same period of last year fell 63%, but the share price of Netflix still soared by nearly 10%. In contrast, Netflix’s profits are truly enviable for the huge amount of domestic traffic and a lot of money on video sites. How does it capture users and realize profitability?

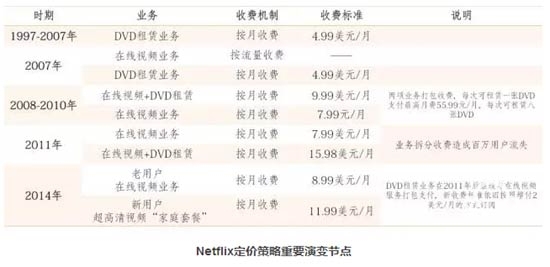

Unlike YouTube, Hulu, etc., which provide users with free content, relying primarily on advertising revenue to achieve profitable models, Netflix attracts users with relatively low content subscription fees and quality services, and generates revenue on a scale basis. In this model, Netflix migrated the profitability of the original DVD leasing business to an online video service to some extent. “They often fall into the trap of spending due to low prices, but they are often busy renting a DVD for a month. Netflix’s deep understanding of users also works on the Internet and even performs better.â€

Netflix’s online video business initially implemented a fee-for-service system, and after one year changed to pay $7.99 a month for unlimited online viewing. In Netflix’s case, in the wake of the widening Internet bandwidth in 2007, the company’s online video was less than 5 cents in operating costs, which significantly reduced the original huge cost. Low prices and sufficient content bring Netflix a large number of users. In addition, Netflix offers more personalized services, such as free trial for one month for users, and monthly billing for users can be cancelled at any time; the website recommends videos based on users' viewing preferences. As a result, Netflix's economic performance has steadily increased, making it the most popular online video site in the United States, and subscribers continue to grow rapidly.

Of course, Netflix's profit model still faces growth challenges. Network operators are dissatisfied with Netflix's huge traffic and occupy a large amount of loans. They require websites to pay for network construction. Content providers are asking more and more. The cost of purchasing content from Netflix has increased from 950 million in 2009 to 5 billion today. Dollars. With the increase in cost and the increase in the size of users, Netflix in 2014 took ultra-clear video development as an opportunity to increase subscription fees. Although Netflix believes that with the further improvement of content and service and word-of-mouth promotion, the small price increase of only US$1 will not have a huge impact on users, but the growth of only 2.66 million paying users in the third quarter of 2014 was far lower. The facts expected by investors are undeniable. To explore its essence, Netflix's mature profit model has too single a risk. The sharp increase in the cost of content purchase and network construction has impacted on the company's profitability; the scale of online video users in the US and even the world is virtually certain, and expansion has boundaries, and the continued slowdown in the number of users is likely to make it difficult for Netflix to maintain current profitability. . Netflix's flexible pricing strategy and mature profitable thinking still cannot avoid the important problem of too single profitable mode. Properly cultivating or introducing multiple profit models is the long-term development plan.

Radical Thinking: Content Retrieval

Netflix understands that the development of the video industry in the new era is inseparable from the control of excellent content. Content is the core of development, and its content strategy is relatively "radical." In the past two years, Netflix has continuously increased the price of purchasing content: the purchase of Disney's movie resources from 2006 to 2016 will cost US$350 million annually, and the cooperation price with DreamWorks reaches US$30 million per movie. The latest contract value with the EPIX pay-TV channel is also worth $1 billion. In addition, bold attempts in content production and content marketing are also quite subversive.

The way to get content

Although Netflix accumulated a large amount of DVD resources earlier than other video sites, it is difficult to satisfy the discerning user appetites with only classic old movies. Despite the immense challenges of identity conversion to Netflix's content purchase, it is still possible to have a large user base and a stable source of income. On the one hand, Netflix has relatively sufficient capital to pay higher prices for the film. With price temptation, almost all American entertainment content providers work with Netflix. On the other hand, the huge scale advantage allows Netflix to have certain bargaining power in cooperation with suppliers, purchase premium content at an appropriate price, attract users, and thus form a virtuous circle.

In many collaborations, DreamWorks has parted ways with HBO, switching to feature film and television dramas through Netflix, and tailoring new shows for Netflix. In return, Netflix enjoys DreamWorks’ exclusive rights to all animation series worldwide. In addition, new movies produced by Disney and Pixar will also move from Starz to Netflix.

Production: Change Production Mode

Netflix used the big data reputed by the media to guide production, and to a certain extent changed the production mode of TV dramas. Netflix knows users accurately by collecting and analyzing data that users generate on Netflix such as pauses, replays, and more than 30 million daily actions, as well as 4 million ratings and 3 million searches (such as querying showplay time and equipment). Preferences, targeted selection of topics, rewriting scenarios. To truly understand user viewing preferences, Netflix created at least 70,000 video "micro-genres" with extremely detailed entry points to subdivide existing video content. The company called this sorting process "altgenres" internally, breaking the original classification method of film type. The tens of thousands of subdivided movie attributes are matched with thousands of users' viewing habits data to guide production and form the advantages of Netflix content production.

In addition to using data, Netflix is ​​working to enhance the content advantage by cooperating to produce real 4K content. For example, in cooperation with Sony, the 4K version of “The Deadly Addict†was released. In collaboration with Dolby Laboratories, the latest DolbyVision technology helped Netflix enhance the ultra-high definition and high-definition video fidelity of online streaming media. However, the number of 4K producers currently collaborating with Netflix is ​​still small, and there is still much room for development in the future.

Marketing: Insight into user value

Netflix's content marketing has its own style. In the original drama marketing, Netflix pinpoints the market positioning and uses hot topics to package and arrange original dramas. Between the original dramas of 2013, the proper time interval was maintained, and the appetite of the audience was overwhelmed. The on-demand rate of each new drama exceeded expectations. When Amazon promoted "AlphaHouse", it began to emphasize the role of the director in the production process, and Netflix has been leading the production of "Producer's Behind the Scenes" video in the marketing of new dramas.

In addition, Netflix’s use of premiere strategy is also an important means of its content marketing. Netflix took the lead in launching the first episode, covering as many audiences as possible, continuing to ferment some topics to attract attention. The premiere strategy is a double-edged sword. On the one hand, Netflix competes directly with the cable television channel and has to spend more on content production. On the other hand, snatching the premiere rights, Netflix's annual copyright purchase cost, is already close to 50% of revenue.

Global Thinking: Techniques both inside and outside

Peeling the cloak of an online video service provider, Netflix is ​​essentially a technology company. Internally, Netflix relies on strong computing power; externally, it needs a solid, fast, and smooth network to support normal website operations. Netflix looks at the overall internal enhancement of technical strength, and improves the external network as a convergence path.

Internal system architecture: acting as a pioneer in technology

In 2009, Netflix began using Amazon’s AWS services for video transcoding, which required a lot of computing resources to run. Netflix refers to its software architecture in AWS as "Lambo," thereby emphasizing that each individual system has the ability to independently operate successfully, and that when other systems fail, it can still operate as usual. For example, when the recommendation system stops working, the user can still continue to order video on demand, but the recommendation they see will be a popular movie rather than a personalized recommendation.

"We're equivalent to paying the Pioneer Tax," said Ruslan Menshenberg of Netflix's cloud platform. At the time, Netflix was probably the boldest company to start using public clouds on a large scale. Netflix gradually transferred all its business to AWS and developed a series of tools based on this, which will enable it to respond to rapidly growing subscribers over the next five years and expand the business to more countries and area.

External Network Construction: Self-construction and Cooperation

As one of the most important video content providers, Netflix has a lot of demand for Internet traffic. Netflix started by relying on content services, without any physical network as a basis, which made it necessary to consider participating in the construction of the Internet through cooperative projects, and in 2012 launched OpenConnect, its open source CDN (content distribution network) project. This project provides Netflix with a better online environment, while at the same time it can obtain preferential treatment from Internet service providers and force competitors, especially cable operators, to cooperate with it.

So far, the four major U.S. broadband companies have provided Netflix with a "fast lane" for direct Internet access. However, in order to meet the expanding business scale, Netflix paid for the two major Internet Service Providers (ISPs) in the United States, bypassing network brokers and directly connecting its own services to the company's network.

Linkage Thinking: Terminal Communication

More and more smart TV devices will have Netflix content built-in, such as Chromecast, keyword/keyword, Apple keyword/keyword TV, NBPD set-top box, etc. It is becoming easier for users to watch Netflix content. Netflix's Ultra HD content has also been implanted with a number of smart TVs, including Samsung, Sony, Vizio and LG. Buyers of these TVs, if already Netflix users, can watch the video directly on the TV. Netflix's emphasis on game console terminals is unique. From the three consoles Xbox, Wii and PS3 to the next-generation handheld 3DS and PSV, Netflix has achieved full coverage. The comprehensive coverage of multiple terminals provides Netflix with the possibility of ridding the terminal of the lack of difficulties and implementing multi-screen linkage.

Netflix enters Asia with geometric ambitions behind

This content is copyrighted exclusively by SofaNet. Welcome manufacturers to further exchanges and cooperation with us to create more in-depth product reports.

Smart TV box recommended to install sofa butler, download address: http://app.shafa.com/

Sofa Net is an Internet technology company specializing in smart TVs and boxes. It owns popular products such as sofa butlers, sofa tables, and sofa forums. It has been committed to providing high quality application resources for smart TV and TV box users and active community exchanges. And authoritative evaluation of smart TV products.